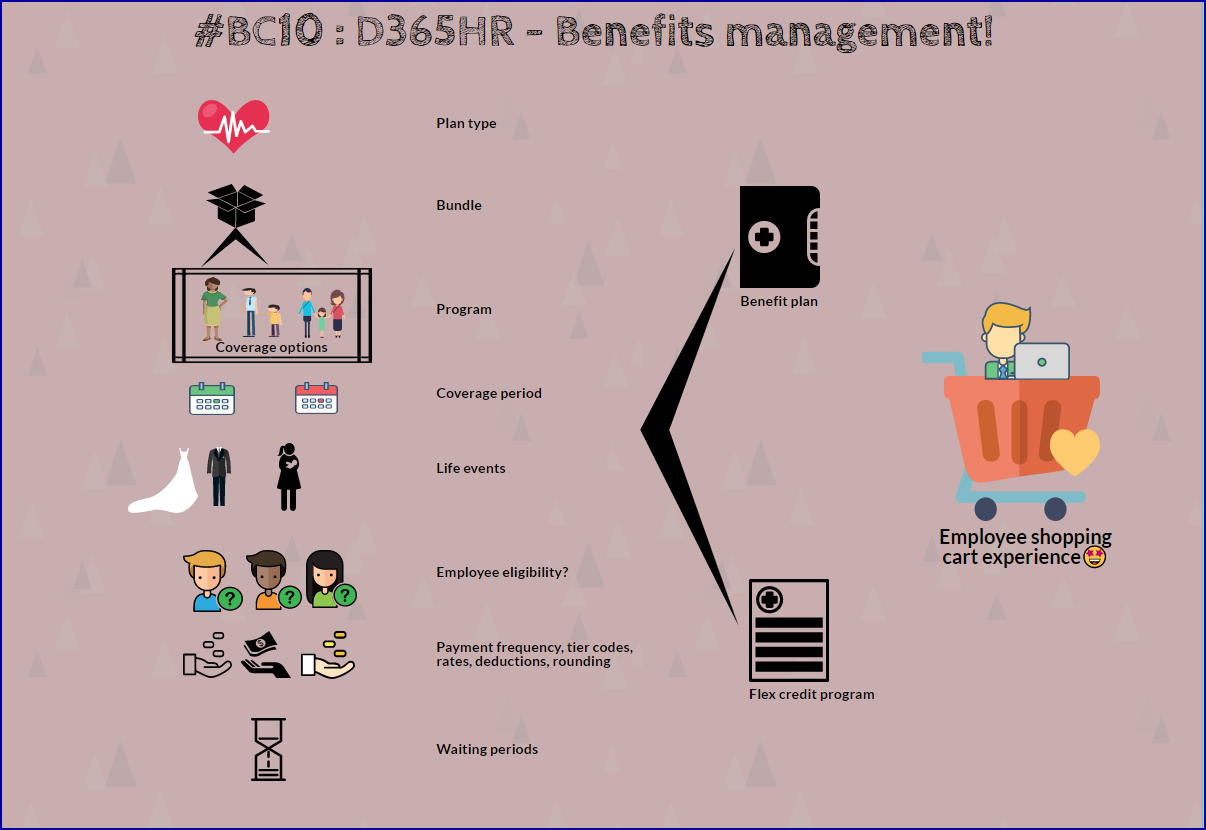

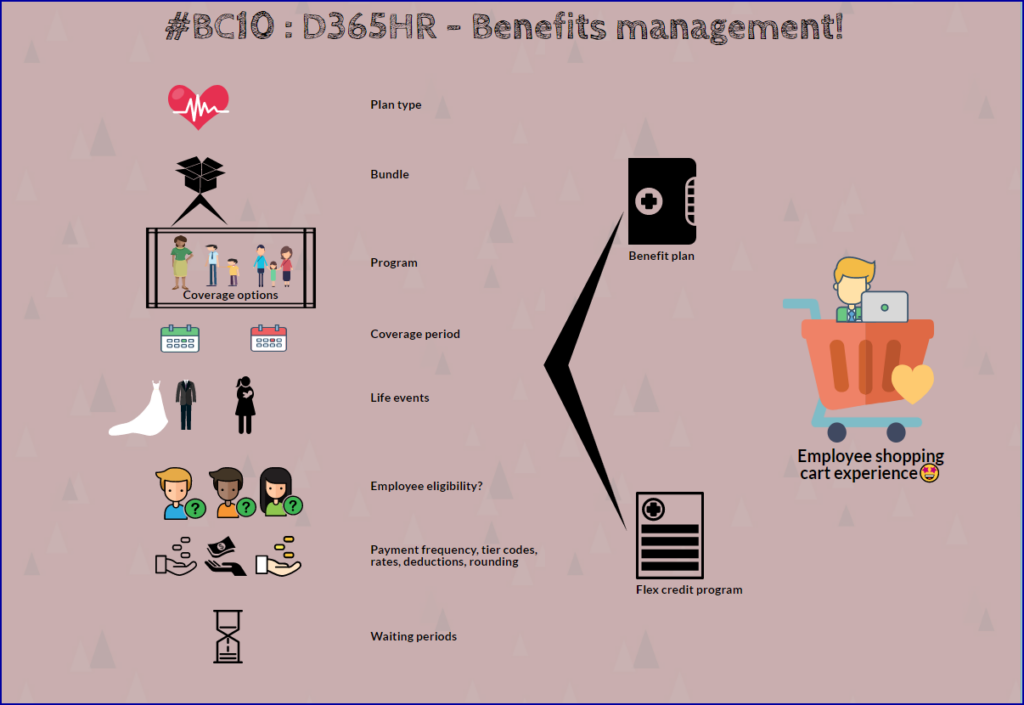

With the overall strategic investments announced in the area of Dynamics 365 Human Resources last year and the constant release of new functionalities from early this year – the benefits management functionality on Dynamics 365 Human Resources has been continuously enhanced.I have had a chance to explore the enhancements available as part of my Digital HR transformation engagements and have summarized the capabilities into 3 areas:

- What are core product functional features?

- How do these product functional features combine to define a Benefits program for a company?

- What is the key highlight of the enhanced functionality?

What are core product functional features?

Bundles, Periods and Programs

Scenario: Let’s say a company Hogwarts manufacturing offers a health insurance plan where an employee can opt for a dependent coverage plan only when the employee is covered already. This health insurance plan coverage run from January to December every year and the employees are allowed to make changes only one every year in the month of December. Also both the employee only and dependent benefit plans are eligible only for employees who have already worked at the company for more than 3 years.

Feature alignment: In this scenario we can define a benefits bundle where the employee only and dependent benefits plans are bundled together and period which runs from January to December and since both the employee only and dependent plans have a common eligibility rule of minimum 3 years of working creating a benefit program can help is applying common eligibility rules on both the plans.

Benefit plan types

Scenario: Let’s say a company Hogwarts manufacturing offers 2 types of benefits related to Health and LifeFeature alignment: We have to define 2 Benefit Plan Types: Health and Life to group the 2 benefit offering from the company. In essence benefit plan types provide a high level grouping to aggregate parameters such as:

- If employees can have more than one plan enrollment of the same plan type or not

- Weather Beneficiary or Dependent are the contact for this plan type

- What are the different coverage options available within a plan type and

- What life events are assigned as part of a plan type

Coverage options and Benefit plan types

Scenario: Let’s say a company Hogwarts manufacturing offers a health insurance plan where an employee can opt for a dependent coverage plan only when the employee is covered already. This health insurance plan coverage run from January to December every year and the employees are allowed to make changes only one every year in the month of December. Also both the employee only and dependent benefit plans are eligible only for employees who have already worked at the company for more than 3 years. Hogwarts manufacturing also offers a life insurance plan which is worth 5 times the employee’s salary

Feature alignment: In this scenario we define a Health Insurance plan type and assign 2 coverage options: Employee only and the dependent benefit plan can have the coverage options of Employee+1, Family, Employee + Children. Also we define a Life insurance plan type and assign a coverage option: 5 x salary

Life events and Benefit plan types, Life event changes and Life event based eligibility

Scenario: Let’s consider the 3 scenarios below:

- Rudy working at Hogwarts manufacturing moves from small village to a metro city and due to this the health insurance plan he is covered in needs to be changed for a different option.

- Nina got married this month and wants to include her spouse to be covered for health insurance.

- Ronald was blessed with a baby girl this month and wants to include the new born child to be covered as part of the health insurance

Feature alignment: Change of address, Marriage and Child birth are simply put life events that occur on the employee and due to the change of circumstances employees benefits plan enrollment changes. Dynamics 365 Human resources supports defining these life events and based on the changes of the employee data the determination of different benefit plan type eligibility can be automated as and when they occur

Payment frequencies

Payment frequencies are used to determine annual benefit salary and the premium amount an employee pays each period and also the frequency of the payments to the benefits providers. The payment frequency conversion factors include Annual, Semiannual, Quarterly, Monthly, Semimonthly, Biweekly, Weekly, Daily, Hourly

Detailed eligibility criteria

One of the critical enhancements in the benefits management capability is to be able to define complex eligibility criteria on the benefit plans to reduce manual intervention of the Benefits manager and to improve automation of benefits plan enrollment processing. We can use the following parameters to define almost all possible combinations of eligibility rules.

- Personal contact eligibility options give the capability of restricting a benefit plan based on the type of relationship between the employee and dependent or based on the age of the dependent

- Eligibility can be defined based on Worker type (Employee/Contractor), Employment category(user defined), Employee status(System defined limited set of values)

- In case if the employer provides specific benefits to employees based on previous status of employment – This can be defined as a eligibility rule

- A new hire rule can be defined to have a restricted eligibility for new hires for a few months after the hire date.

- Eligibility can be defined based on age

- Restrictions based on the employee’s position and job details: department, job, Job function, Job type, Compensation region, Position, Position type, Labor union

- Benefit plans can be restricted for specific legal entities

- Eligibility can be defined based on employee address parameters: State and Zip/Postal code

- Benefits plans can also be restricted to employee with some specific contract types using terms of employment

Tier codes, Rates, Deductions and Rounding rules

In simplified terms rates are used to define how much it costs for the employee and employer for a particular benefit plan enrollment. In case of complex benefit rate calculations where the benefit rates are calculated based on the following parameters, then tier based calculation is used:

- Age

- Salary

- Physical

- Gender

- Full time equivalent

- Job type

- Compensation region

- Level

There are 2 options to manage all complicated scenarios of any organization – Single tier calculation and Double tier calculation Deductions are used to define the link between the benefit rates to be deducted from the employee’s pay check and the payroll system that is processing the deductions. Rounding rules support in rounding up or down the decimal values calculated for the annual benefit salary Waiting days and Waiting periodsWaiting periods in combination of waiting days support the calculation of exact number of days to wait before the employee is eligible for enrollment into a benefit plan.Coverage and Deduction waiting periods are linked to the Benefit plan eligibility rules.

How do these product functional features combine to define a Benefits program for a company?

Benefit Plans

Scenario: Let’s say a company Hogwarts manufacturing offers a health insurance plan where an employee can opt for a dependent coverage plan only when the employee is covered already. This health insurance plan coverage run from January to December every year and the employees are allowed to make changes only one every year in the month of December. Also both the employee only and dependent benefit plans are eligible only for employees who have already worked at the company for more than 3 years.

Feature alignment: In order to define a benefits program aligned with this we can define 3 benefit plans on Dynamics 365 Human Resources which will include the finer design referring all the product functional features I have explained above.Essentially benefit plans are pivoting part of the benefit program alignment with the product functional features and this is what will be used by the employee for enrollment

Flex credit programs

Scenario: Let’s say a company Hogwarts manufacturing offers 3 benefit plans to its employees:· Health insurance employee only – 100· Health insurance employee + Dependents – 150· Life insurance employee – 100 And each employee is allocated with 200 credit points that can be used by the employee to decide which benefits are essential and the employees can decide by themselves the benefits plan they want to enrolled into. In this scenario if the employee chooses to enroll into the Health insurance employee + dependents, then employee would be left with 50 credit point that cannot be used.

Feature alignment: We would still define 3 benefit plans in this scenario, but each of them will have a flex credit rate. Additionally we have to define a flex credit program that employees can use for enrollment.

What is the key highlight of the enhanced functionality?

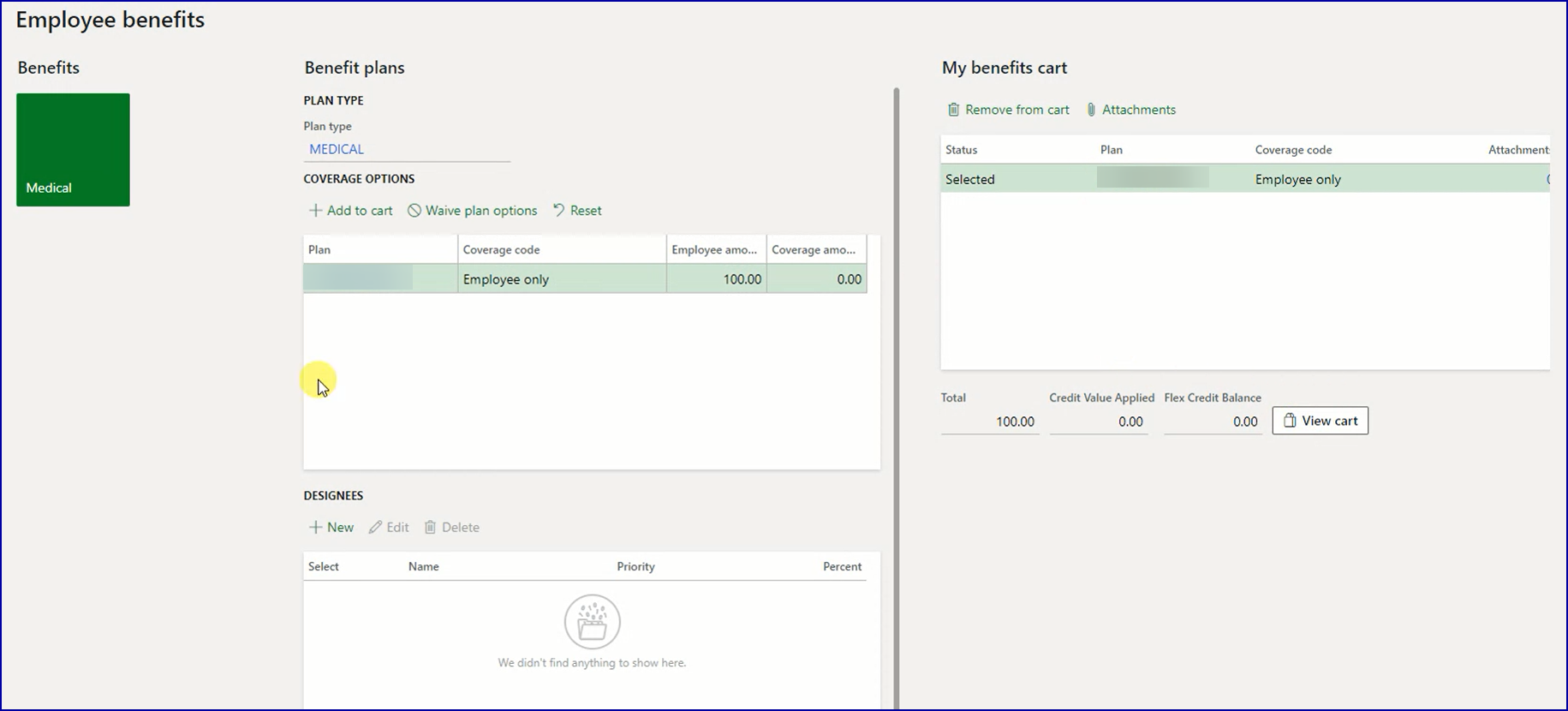

The strategical focus of the product team is all about improving employee experience and enhancement of Benefits management is a key step in this direction with the all the shopping cart experience on Employee Self Service.With this capability the employees are empowered and involved in making the decisions about what benefit plans they want to enrolled into and also get a complete overview of the benefits enrollments on employee self service. The below screenshot gives an overview of the functionality

On a closing note I would say having a powerful functionality such as this that involves employees to be actively part of selection and decision making – this would definitely contribute to improve employee engagement and ease of use. In the end it would contribute its part of helping Business continuity!

Want to know more about Dynamics 365 Human Resources… Stay tuned and subscribe to my blog😀:

Do you think my blog helped you? Then please share it with your network on LinkedIn!